About Us

I am a hypnotist from West Yorkshire in the UK. I can help you to access your inner resources and form practical strategies to free you from the unnecessary feelings of anxiety.

Contact Info

Useful Links

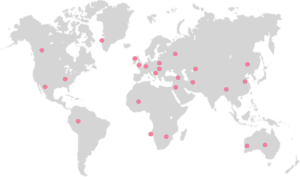

Worldwide

© Copyright | Richard Ogden Hypnosis | Privacy Policy